The Central Bank of Nigeria (CBN) has increased the maximum weekly limit for cash withdrawals across all channels by individuals and corporate organisations to N500,000 and N5 million, respectively.

The apex bank announced this in a letter addressed to banks and other financial institutions.

"The maximum weekly limit for cash withdrawal across all channels by individuals and corporate organizations shall be #500,000.00 and #5,000,000.00 respectively," the letter signed by Haruna B. Mustafa, the director of banking supervision read.

The CBN explained that it made the decision based on feedback received from stakeholders.

The apex bank warned that any bank that aids and abets the circumvention of the policy will be severely sanctioned. The new police takes effect nationwide from Monday, January 9, 2023.

The CBN further gave room for withdrawals above N500,000 and N5 million in "compelling circumstances".

In such situations, the apex bank said the withdrawals will be subject to a processing fee of 3% and 5% for individuals and corporate organizations, respectively.

Also, to process such withdrawals, banks and other financial institutions must obtain some relevant information from the customers and upload the same to the CBN portal created for the purpose.

The information includes:

a. Valid means of identification of the payee (National ID, International Passport, or Driver's License).

b. Bank Verification Number (BVN) of the payee.

c. Tax Identification Number (TIN) of both the payee and the payer

d. Approval in writing by the MD/CEO of the financial institution authorising the withdrawal.

Giving further directives, the CBN said third-party cheques above N100,000 shall not be eligible for payment over the counter.

The apex bank added that the extant limit of N10 million on clearing cheques still subsists.

According to the CBN, monthly returns on cash withdrawal transactions above the new specified limits should be rendered to the Banking Supervision, Other Financial Institutions Supervision and Payments System Management Departments as applicable.

It reminded banks that compliance with extant AML/CFT regulations relating to KYC, currency and suspicious transaction reporting etc. is mandatory in all circumstances.

The CBN also directed banks to encourage customers to use alternative channels (internet banking, mobile banking apps, USSD, cards/POS, eNaira, etc.) to conduct their banking transactions.

The CBN further noted that it recognised the importance of the roles that Bank and Mobile Money Agents play in the financial system, which include enabling access to financial services in underserved and rural communities.

"They will continue to perform these strategic functions, in line with existing regulations governing their activities.

"The CBN recognizes the vital role that cash plays in supporting underserved and rural communities and will ensure an inclusive approach as it implements the transition to a more cash-less society," the letter read.

Nigerians woke up on Tuesday, December 6, to the news of the policy by the CBN which directed banks to ensure that Over-the-Counter (OTC) cash withdrawals by individuals in a week stood at N100,000, while corporate entities must not exceed N500,000.

The policy, however, caused a nationwide uproar as financial experts, businessmen, politicians and other stakeholders stood against it.

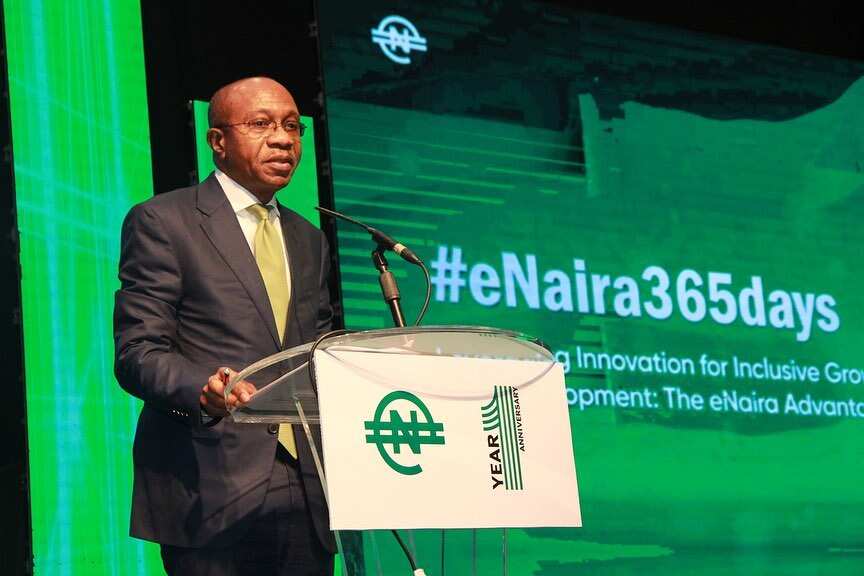

Meanwhile, the CBN has said its governor, Godwin Emefiele, would not be appearing before the House of Representatives on Thursday, December 22 as expected.

The apex bank stated that Emefiele would be represented by the deputy governor on financial system stability, Aisha Ahmad.

The CBN governor had been summoned by the lawmakers to give an explanation about the new cash withdrawal policy

Advertise with us /Share your article : Whatsapp: +2348146532265, Email: transviewmagazine@gmail.com

No comments:

Post a Comment